176 4th St (and its sister property 180 4th St) are properties I became aware of through the FMLS feed of my Cherokee County, GA realtor. My evaluation suggests that neither of these are a deal I would want to pursue at this time. It was, however, an interesting property to learn about for a few reasons. The process of evaluating this property shed light on the challenges of low cost properties, pursuing properties available by auction, and the reliability or availability of online information.

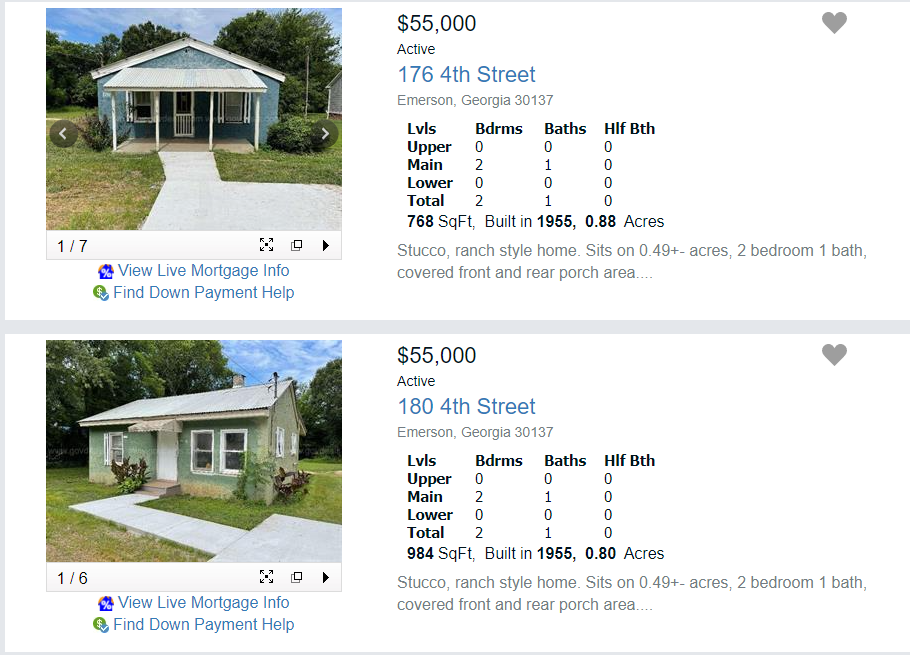

The FMLS listing provided the basic information that I plug into my ‘first glance’ financial formulas to figure out whether I want to devote more time to examining the opportunity.

In this case, for Buy and Hold, 55k list compared to a Rentometer score of 724/month (avg) provides a 1.32% figure for comparison to the 1% Rule. This is a very rough rule, and a very rough calculation, but it’s enough to stimulate further review. For Buy and Sell, recent comps were not great, but suggested an exit window of $130-150K for After Repair Values.

When I started looking closer, I observed a couple things that were interesting and confusing.

The first thing that caught my eye was a lot size of .88 acres. To me, this seems like a pretty large lot and opens the possibility of building additional units or subdividing. While both of those plays are complicated, they do open up additional avenues for profiting on a deal. However, I also noted that an approximately .8 acre lot size was the listed value for BOTH properties. It struck me as odd and unlikely that this was accurate. Not impossible, perhaps, but something that merited additional review.

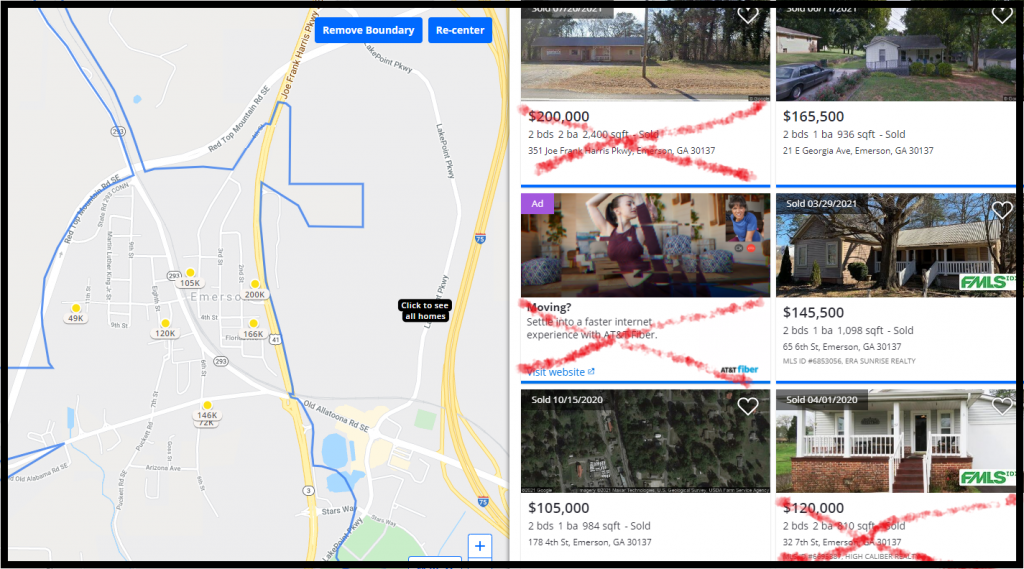

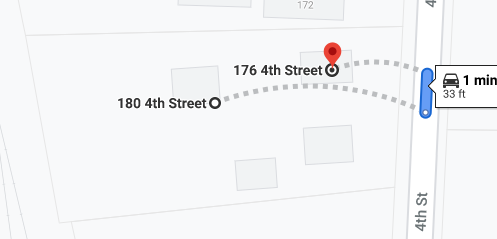

To gain additional insight into the actual lot sizes of the properties, I pulled them up on Google Maps. The lot lines on Google Maps are definitely a ‘best effort’ kind of situation so they are not precisely reliable. Similarly, the lag in updates of satellite and Street View imagery on the site may not always give current context. But some data is better than no data.

In this case, my suspicion about whether both properties had a large lot seemed to be borne out. Worse, there was now a suggestion that this is a single lot with 4 structures!

The satellite pics, which are dated this year, include too much tree cover to get an accurate structure count. The Street View images confirm 4 structures (seemingly 3 houses and a shed) but are dated 2013. At this point, it seems unlikely that these properties have nearly an acre each – so some of our exit/profit options are disappearing.

I next performed a search on the Bartow County, GA Tax Assessor’s website. The intrigue deepened when I was unable to find either property. Government online records are also not wildly reliable – so it was possible that this was an error or omission that had an easy explanation. I chose to dig a bit deeper though and looked for ANY properties on Fourth street. That resulted in the discovery of tax records for 178 Fourth Street.

Google Maps drops a pin on the exact same building for the street addresses of 178 and 180, so that was no help in clarifying. However, the tax records for 178 included 2 pictures, of two different houses, in which the house numbers are clearly visible. Those numbers are 176 and 180. We now have enough information to reasonably assume that these 3 homes are all the same tax parcel – whether or not the city / county are keeping good records or getting their taxes.

Next I looked at the property pictures to get a rough sense of the required renovations. Both listings included pictures thankfully and they were reasonably representative of what I saw when I visited. Neither ‘pictures being present’ nor ‘pictures being accurate’ are guaranteed or even common, so I was grateful for the added detail.

The images suggested a significant reno/rehab would be required. There was visible decay and neglect in each image. I’m still learning how to accurately ballpark the costs of a rehab. However, if my extremely rough estimates of the amount of work required (a lot) and the cost of that work (25k-50k) are accurate, we were looking at declining probabilities of viability. Those figures almost certainly push the rental model out of the 1% window and would significantly dent any desired flip margin. It did occur to me that there was an economy of scale available in acquiring BOTH properties and rehabbing them concurrently. This would be convenient for the rehab team because of their colocation (and presumably cheaper as a result). However, successfully claiming both deals is easier said than done.

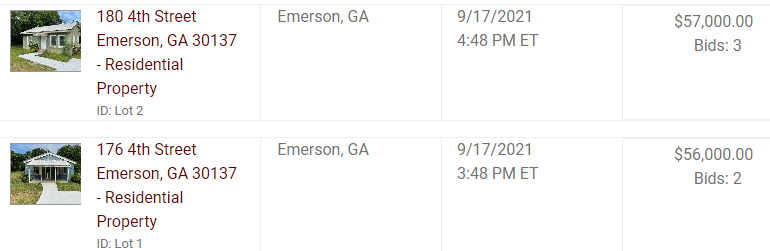

One other observation I had of the property images was the http://govdeals.com watermark on each image. A search of that site surfaced 2 auction listings that matched these FMLS listings, albeit with better information.

Some highlights:

- For sale by the City of Emerson itself

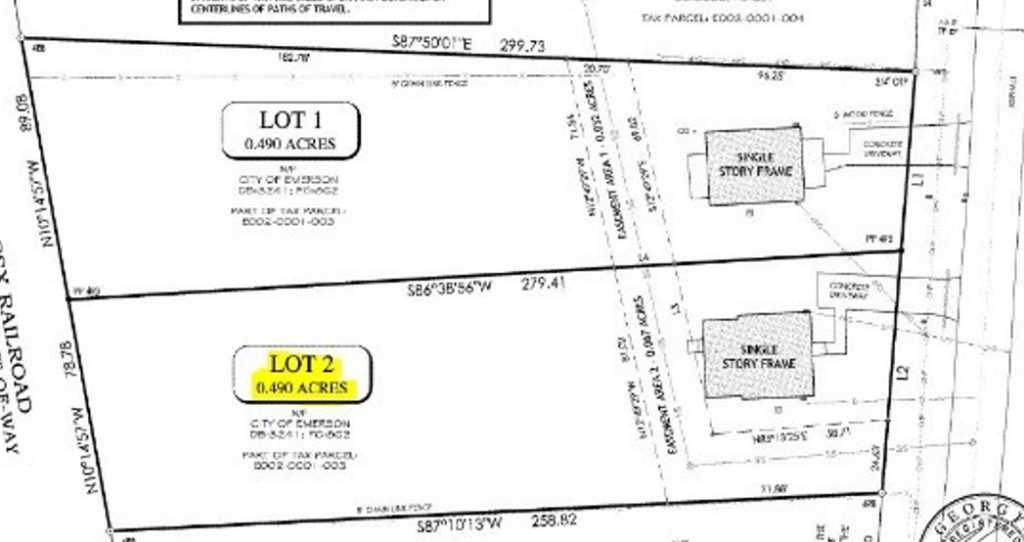

- Lot size is approximately .49 acre and consists of land and single family home

- Title/Deed Conveyance: Special Warranty

- i.e. Caveat Emptor about liens and other encumbrances

- All showings would be at specific times outlined in the listing

- A Q&A section with the following reply to a customer with similar questions to me:

- Houses 180, 178, and 176 were previously on a single lot. House 178, which was in the rear of 180 and 176 was demolished. The lot was then split into two lots separating 180 from 176.

The overall set of information at this point suggested that this would be a sufficiently complicated deal that it might not be ideal for my purposes. I was still very curious about the difference between the information listed on the auction site, the FMLS, and the Tax site. I elected to visit the properties during the first viewing window to gain more insight.

When I arrived, I found that the site had in fact been substantially altered as outlined in the auction site reply. There are now only the 2 homes present with one home and the shed being removed. Additionally, there was a City of Emerson government representative present who offered some further info. The demolished house and shed had been erected (perhaps illegally) over a buried sewer line which the city needed access to. The city had not established an easement on the original lot. I inquired if this was an eminent domain situation. The rep said no. This was resolved when the city purchased the property and all structures at an estate sale (arms length).

The city then performed the teardowns, subdivided the lot, and recorded the easement. This was all recent enough that the tax site has not been updated. The rep also pointed out a Survey that I’d missed – which was attached to the auction site listing.

In conclusion, this was an interesting research adventure. I have a better understanding of how to locate a variety of data and how much to trust the results. I will probably not pursue these properties any further. I can see how it might be viable though, if I had several deals under my belt and a solid contractor team.